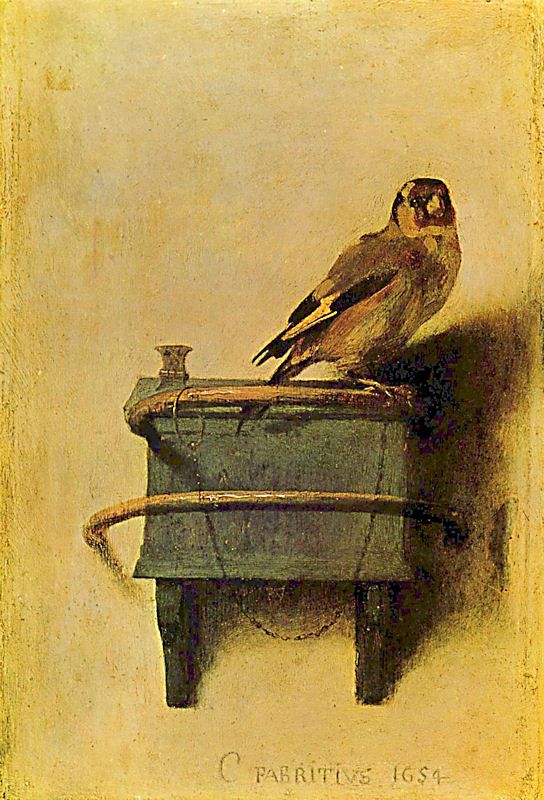

Just finished reading “The

Goldfinch”, a book by Donna Tartt that recently won the Pulitzer

prize in fiction for 2014. While I enjoyed my journey through the at-times-agonizingly-long story, what's lingering

on in my mind at the end of it all is a fascination for the painting itself,

that little masterpiece by Fabritius, the theme of & inspiration behind the

book.

The painting’s composition as intended by Carel Fabritius and/ or as inferred by the viewer seemingly evoked emotions of varied

hues within the author and articulated through the protagonist, emotions

ranging from feeling of angst, identifying with the chained but resolute bird; an

overwhelming urge to free the creature from its misery and thus a symbolic

effort at deliverance of a shackled self and finally a submission to the

status quo, a realization that you cannot choose the being you want to be…. More than anywhere else where there's a more direct reference to the painting, I feel the text quoted below is where the author most eloquently delves into the existential angst as represented by the chained bird;

"A great sorrow, and one that I am only beginning to understand: we don't get to choose our own hearts. We can't make ourselves want what's good for us or what's good for other people. We don't get to choose the people we are.

Because--isn't it drilled into us constantly, from childhood on, an unquestioned platitude in the culture--? From William Blake to Lady Gaga, from Rousseau to Rumi to Tosca to Mister Rogers, it's a curiously uniform message, accepted from high to low: when in doubt, what to do? How do we know what's right for us? Every shrink, every career counselor, every Disney princess knows the answer: "Be yourself." "Follow your heart."

Only here's what I really, really want someone to explain to me. What if one happens to be possessed of a heart that can't be trusted--? What if the heart, for its own unfathomable reasons, leads one willfully and in a cloud of unspeakable radiance away from health, domesticity, civic responsibility and strong social connections and all the blandly-held common virtues and instead straight toward a beautiful flare of ruin, self-immolation, disaster?...If your deepest self is singing and coaxing you straight toward the bonfire, is it better to turn away? Stop your ears with wax? Ignore all the perverse glory your heart is screaming at you? Set yourself on the course that will lead you dutifully towards the norm, reasonable hours and regular medical check-ups, stable relationships and steady career advancement the New York Times and brunch on Sunday, all with the promise of being somehow a better person? Or...is it better to throw yourself head first and laughing into the holy rage calling your name?”

Because--isn't it drilled into us constantly, from childhood on, an unquestioned platitude in the culture--? From William Blake to Lady Gaga, from Rousseau to Rumi to Tosca to Mister Rogers, it's a curiously uniform message, accepted from high to low: when in doubt, what to do? How do we know what's right for us? Every shrink, every career counselor, every Disney princess knows the answer: "Be yourself." "Follow your heart."

Only here's what I really, really want someone to explain to me. What if one happens to be possessed of a heart that can't be trusted--? What if the heart, for its own unfathomable reasons, leads one willfully and in a cloud of unspeakable radiance away from health, domesticity, civic responsibility and strong social connections and all the blandly-held common virtues and instead straight toward a beautiful flare of ruin, self-immolation, disaster?...If your deepest self is singing and coaxing you straight toward the bonfire, is it better to turn away? Stop your ears with wax? Ignore all the perverse glory your heart is screaming at you? Set yourself on the course that will lead you dutifully towards the norm, reasonable hours and regular medical check-ups, stable relationships and steady career advancement the New York Times and brunch on Sunday, all with the promise of being somehow a better person? Or...is it better to throw yourself head first and laughing into the holy rage calling your name?”

When I look at the painting, my first impulse

is to agonize over its chained status, it's limited boundaries & it's still stoical disposition in such a dismal state. The subsequent thought is if

whether the bird even if unchained would challenge its boundaries, having never

ever experienced a free life & but then a sliver of hope emerges that a free-will can never be chained. Do I associate myself with any, all of these… probably

yes, probably no… I guess the given context; the prevailing mental-state determines the

feelings and association with self.

Look long & hard enough; this living bird could enliven your brain.

And yes, get the book! It’s for keeps.